Planning for Your Future with Retirement Living Standards

The increasing trend of workplace pension savings has provided individuals with more information, choices, and responsibilities regarding their retirement savings. However, it raises a crucial question: will the future you envision align with the reality of what you can afford?

The Retirement Living Standards developed by the Pension and Lifetime Savings Association (PLSA) aim to address this concern by describing the lifestyle you can expect to achieve in retirement based on your savings. By offering practical, relatable figures, they provide a benchmark to help you develop personalised retirement targets, based on your circumstances and aspirations.

Understanding the Standards

The PLSA has outlined three levels of retirement living: Minimum, Moderate, and Comfortable. They aim to demonstrate what life in retirement looks like at each level and what a range of common goods and services might cost at each level.

Minimum Standard

- Single: £14,400 per year

- Couple: £22,400 per year

At this level, individuals can cover all their essential needs with some funds left over for discretionary spending. For instance:

- Housing: DIY maintenance costing £100 annually.

- Food: £50 per week on groceries, £25 per month dining out, £15 per fortnight on takeaways.

- Transport: No car, £10 weekly on taxis, £100 yearly on rail fares.

- Holidays & Leisure: One week-long UK holiday, basic TV and broadband with one streaming service.

- Clothing & Personal: Up to £630 yearly for clothing and footwear.

- Helping Others: £20 per birthday/Christmas gift, £50 yearly charity donations.

Moderate Standard

- Single: £31,300 per year

- Couple: £43,100 per year

This standard offers greater financial security and flexibility. Example expenditures include:

- Housing: Annual maintenance and decorating help.

- Food: £55 weekly on groceries, £30 weekly dining out, £10 weekly on takeaways, £100 monthly for meals out.

- Transport: A three-year-old small car replaced every seven years, £20 monthly on taxis, £100 yearly on rail fares.

- Holidays & Leisure: A fortnight 3-star all-inclusive Mediterranean holiday and a UK weekend break, basic TV and broadband with two streaming services.

- Clothing & Personal: Up to £1,500 yearly for clothing and footwear.

- Helping Others: £30 per birthday/Christmas gift, £200 yearly charity donations, £1,000 yearly for family support.

Comfortable Standard

- Single: £43,100 per year

- Couple: £59,000 per year

This level offers significant financial freedom and luxuries. Example expenditures include:

- Housing: Kitchen and bathroom replacements every 10-15 years.

- Food: £70 weekly on groceries, £40 weekly dining out, £20 weekly on takeaways, £100 monthly for meals out.

- Transport: A three-year-old small car replaced every five years, £20 monthly on taxis, £200 yearly on rail fares.

- Holidays & Leisure: A fortnight 4-star holiday in the Mediterranean and three UK weekend breaks, extensive bundled broadband and TV subscription.

- Clothing & Personal: Up to £1,500 yearly for clothing and footwear.

- Helping Others: £50 per birthday/Christmas gift, £25 monthly charity donations, £1,000 yearly for family support.

For many people, their private and State pensions (full State pension for 2024-25 is £11,500 per year), and other savings could go a long way towards paying for their ongoing annual costs.

Saving for Each Level

But how much do you need in your retirement pot to produce each standard of income? It is important to remember that everyone’s circumstances differ. You may need to consider additional costs like mortgage payments, social care or tax on your pension income.

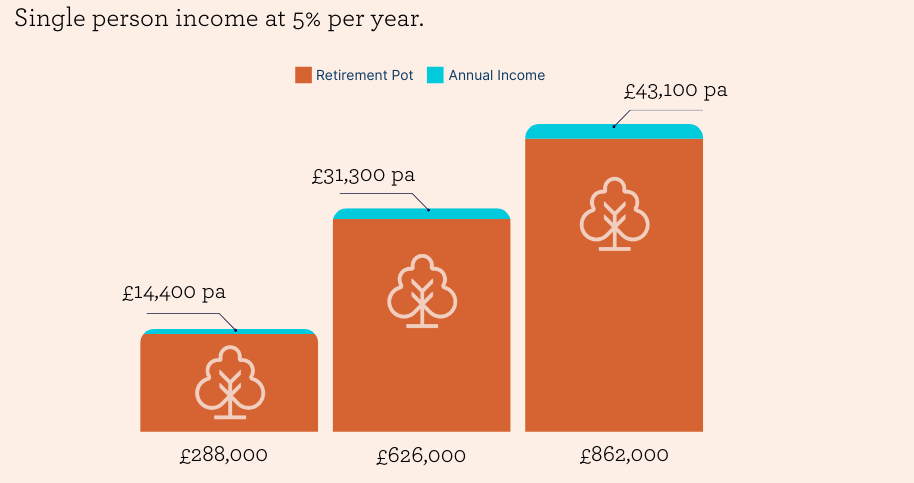

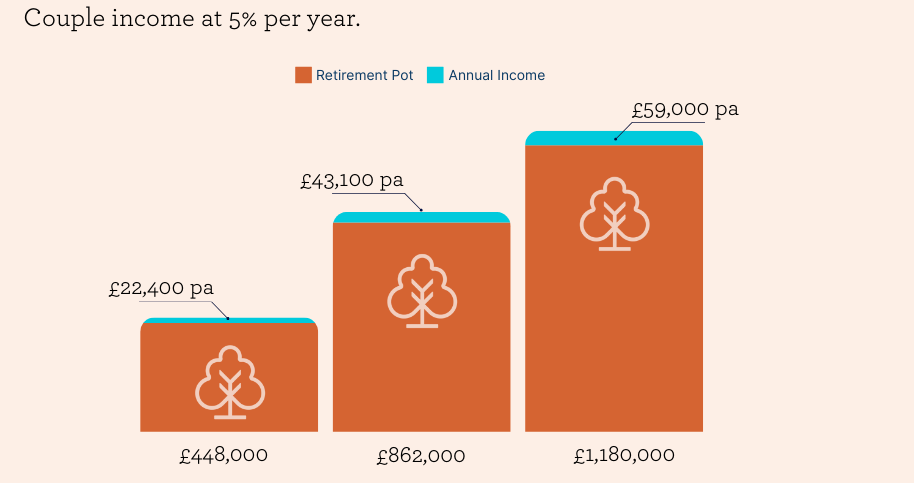

Assuming you draw an income of 5% per year, you would need the following amounts to provide you with the minimum, moderate and comfortable standards of retirement income:

- Minimum (single): £288,000

- Minimum (couple): £448,000

- Moderate (single): £626,000

- Moderate (couple): £862,000

- Comfortable (single): £862,000

- Comfortable (couple): £1,180,000

These figures do not take into account any State pension payments. The following graphs help to illustrate the retirement pot and income at each level, both as an individual and a couple.

By understanding these benchmarks, we can work with you to better plan for your retirement, ensuring you are on the right path to your desired retirement lifestyle.

Disclaimer

Please note, the statistics contained in this article were devised by the PLSA in conjunction with Loughborough University. The PLSA update the standards on a regular basis, carrying out further research with people across the country to ensure that the retirement living standards remain current, incorporating changes in the costs of goods and services as well as reflecting any changes in people’s expectations for retirement. The latest research was carried out in 2023. The information contained in this article is not a personal recommendation and should not be construed as advice. If you are unsure about the suitability of a particular investment strategy, you should speak to an authorised financial adviser.

Wise Investments Limited is authorised and regulated by the Financial Conduct Authority, reference number 230553. Registered in England 4970458.

Source: Retirement Living Standards

Client Login

Client Login